The Market-Reputation Thesis

Research

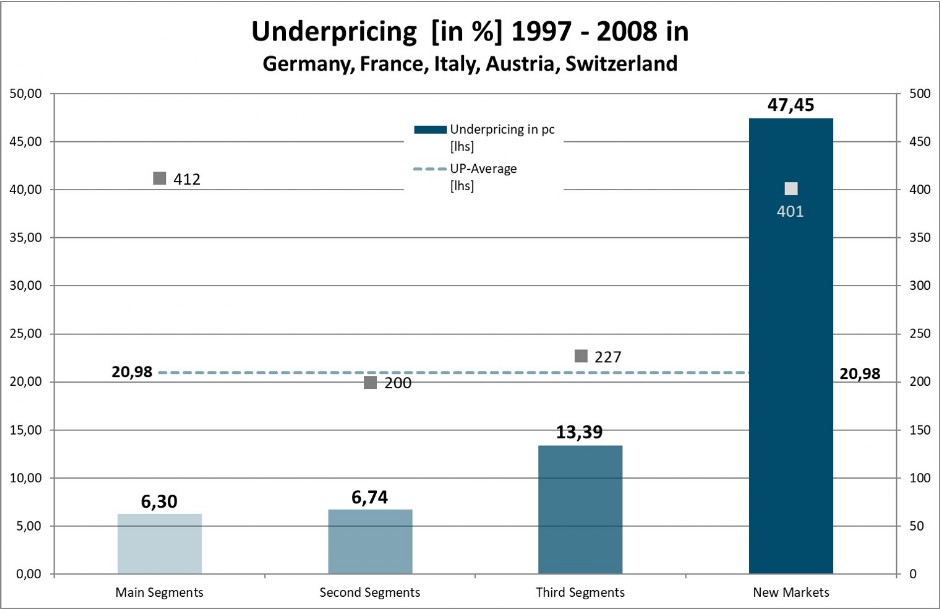

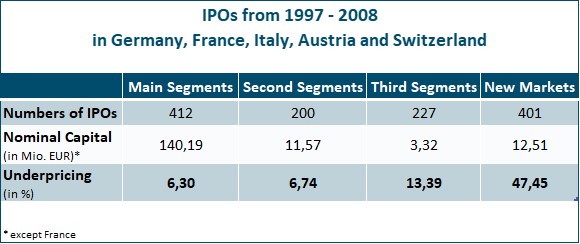

Main subject of my current research is the context of

vertical market segmentation and IPO-underpricing. On the

basis of an empirical analysis of the European equity markets I am analyzing

especially the influence of the reputation of the prevailing market segments.

My research is based on the analysis of the German,

Austrian, Suisse, Italian and French Equity Markets with about 800 IPOs from

1996 to 2003 and about 400 IPOs from 2004-2008, thus means in total more than

1.200 IPOs.

Underpricing, so the central thesis of my empirical

research, is attributed to the scarcity of suitable (vertical) market segments,

depicting the specific risk of an IPO-debutant.

However, each vertical market segment possesses a

certain reputation due to the respective listing requirements, the marketing of

the stock exchange, there presence in the media and the historical and jurisdictional

arrangement in the national/international capital market. This reputation of

the market segments is correlated that way with the IPO-Underpricing, that

underpricing is the higher, the lower the reputation of the market segment is.

Then, choosing that market segment with the highest

reputation an issuer could maximize his issue proceeds while going public.

However, as long as an issuer is not able or willing to meet those expectancies

of investors in order of the chosen market segment, the issuer will run the

risk of being exposed – and such a behavior could leads to stock price losses

overcompensating the initial (maximized) issue proceeds.

Insofar, it would be more rational, to choose for the

initial public offering a market segment with a lower market reputation und put

up with the underpricing (i.e. reduction of the fair value) because e.g.

investors expectancies attached with an IPO in that market segment could be

more than fulfilled – which could lead to a higher attractiveness of the stock

an therefore will lead to higher stock prices overcompensating the initial

underpricing.

IPO-underpricing, therefore, is the necessary

consequence of the prevailing reputation of the market segments for an IPO –

especially because there are no sufficient market-segments for the various

venture risks. Moreover, the creation of reputation takes place on the basis of

qualitative factors which are not suitable to permit a testimony about the

specific risk of an issuer.

A reduction or elimination of IPO-underpricing

therefore is only possible, when there are sufficient market segments for the

various venture risks. Since, to give an example for the German equity market,

an issuer bears not per se more risks while choosing the Freiverkehr for the

Going Public than an issuer choosing the Amtlicher Handel/Prime Standard.

More information is available in my latest book

"IPO-Underpricing im Kontext einer vertikalen Marktsegmentierung" -

just have a look.

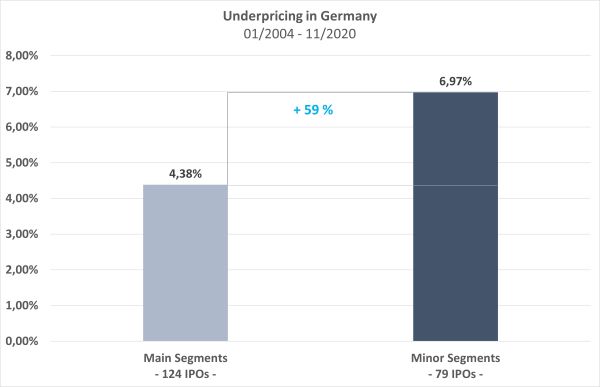

Underpricing in the Post-New Economy-Bubble

The New Markets, which at the time particularly stood for the New Economy, have been a thing of the past since 2003-2005. This can be traced back to a variety of reasons and should not be discussed further here. However, the fact is that many companies with their business model were not sustainable; Cases of fraud and bankruptcies also occurred, resulting in significant stock market losses in the New Markets. The reputation of these market segments had suffered so much that the stock exchange operators gradually terminated these market segments - the few remaining companies moved to other market segments.

In this respect, it makes sense to also ignore the time of the new markets in the analysis of the IPO underpricing

But even after the New Markets have been terminated, there is still significant market-specific underpricing. The following analysis refers exclusively to the current primary market statistics of Deutsche Börsen AG for the period from 2004 to the end of 2020, as the Neuer Markt was closed on June 5, 2003. Since then there is a threefold vertical segmentation "only": Prime Standard, General Standard and the over-the-counter markets such as Entry Standard, Scale and Quotation Board.

A total of 211 initial shares were issued between 2004 and 2020 with an average underpricing of 5.30% - the underpricing remains significant, albeit at a lower level than in the era of the New Markets. This fact alone supports the thesis that the reputation of the market segments must have a significant influence on the amount of underpricing.

A detailed analysis of the aforementioned IPOs also supports the market reputation thesis:

Of the 211 initial share issues, only 8 were in the middle segment of the General Standard - in the years 2004-2007. It can therefore be assumed that these IPOs were still overshadowed by the new markets and a reorientation of the stock exchanges, which is why these IPOs are ignored in the following analysis. This leaves 203 IPOs, of which 124 were in the main segment of the Prime Standard and 79 in the over-the-counter markets (Entry Standard, Scale Quotation Board). The underpricing in the main segment averages 4.38% - in the over-the-counter markets, however, it is 6.97%, which is 59% higher than in the main segment.

The Markt Reputation-Thesis is still alive

Since the IPO underpricing in the lower market segments is on average 59% higher than in the upper market segment, it can still be assumed that the market segment itself has a significant influence on the amount of underpricing. So the market reputation thesis is still alive - even without the New Markets!